So the debate is on. Should Cyprus leave the euro-area (i.e. issue its own currency)?

So the debate is on. Should Cyprus leave the euro-area (i.e. issue its own currency)? Alexander Apostolides says No.

I’ve suggested recently that even the best-performing of the euro-adjustment group (i.e. Ireland, Spain, Italy, Portugal, Greece and now Cyprus) hasn’t performed as well as the least-well-performing East Asia crisis group.

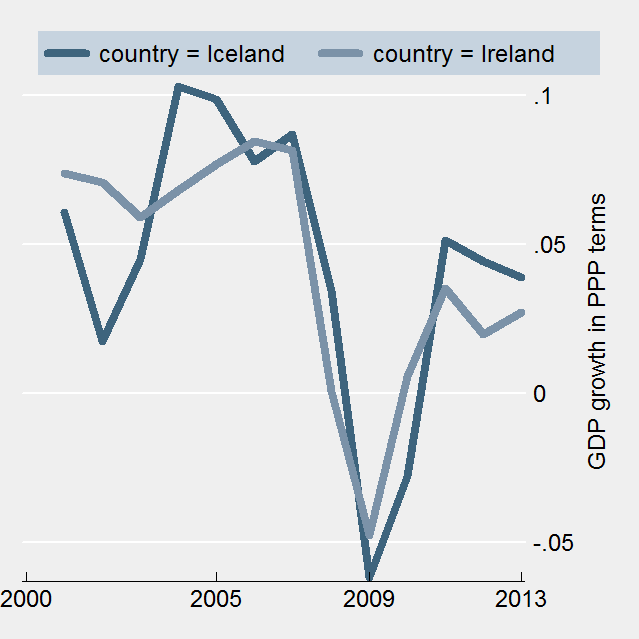

For Cyprus, the comparators are all-too-closer, both in space and time. Ireland and Iceland also witnessed large growth in their banking sectors before suffering a crisis, and having to make extraordinary adjustments.

Iceland devalued; Ireland did not (it would have to leave the euro to devalue). Here is the state of play for these economies. In the graph above, the y-axis is annual change in log-levels of GDP (in PPP terms). So the units should be read as “.05 is 5%”.

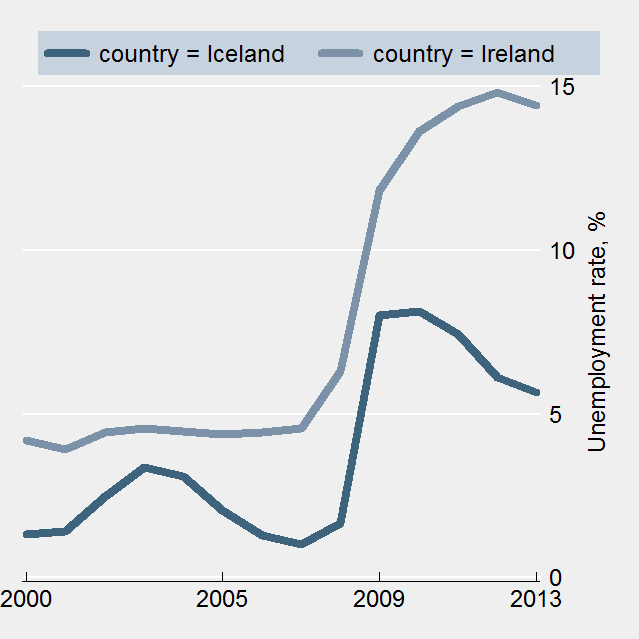

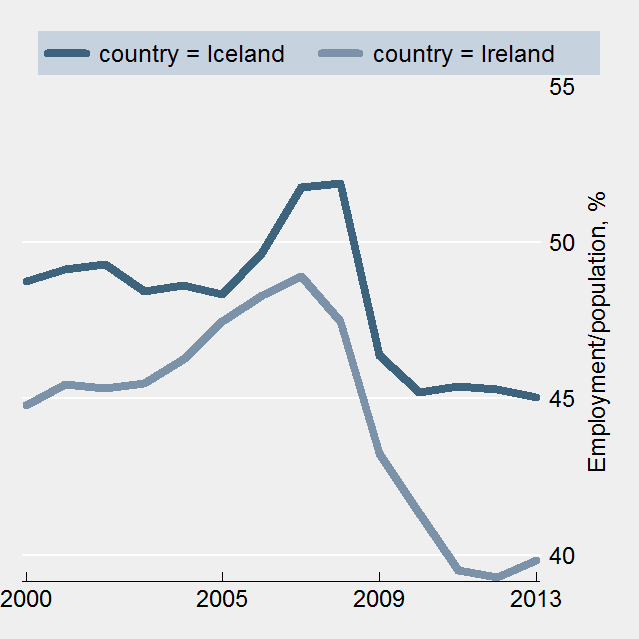

And below are the employment differences.

The source for all of the above is IMF WEO October 2012.

The source for all of the above is IMF WEO October 2012.