|

| Italy source: open-thinking.com |

|

| Portugal source: open-thinking.com |

|

| Spain source: open-thinking.com |

Italy and Portugal do not appear massively overvalued on these measures, about eight percent above where they started in 2000. This should not be hard to remedy. Spain has a further road to travel, about 16% overvalued on the BIS measure of real-effective exchange rates.

|

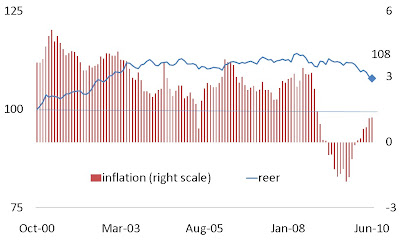

| Ireland source: open-thinking.com |

Ireland is worse off. Notwithstanding some robust deflation, the real exchange rate was still 21% over-valued as of June 2010.

|

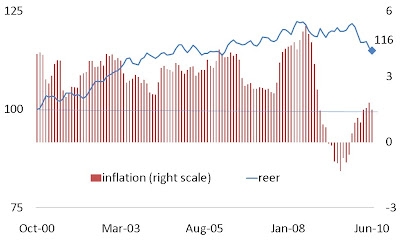

| Greece source: open-thinking.com |

Greece is like Ireland — about 20% overvalued. The difference: Ireland is able to deflate. By contrast, Greece exhibits the opposite. Consumer price growth has accelerated in Greece. This is no salve for the real exchange rate. What’s going on? For one thing, taxes. In order to close the fiscal deficit, the authorities have slapped on large valued-added taxes. Is Greece more Argentina or more Hong Kong? You be the judge.