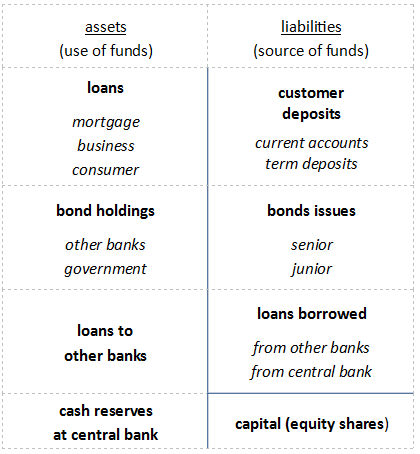

The problem in Cyprus is the banking sector. To get this, you just need to look at the balance sheet of a bank, as above.

The problem in Cyprus is the banking sector. To get this, you just need to look at the balance sheet of a bank, as above. Cyprus banks saw the value of their assets fall in several categories above. They were exposed to mortgages in Cyprus itself (in other words: they were mortgage lenders), which has seen a decline in property prices. You know how people say, “You don’t own your house, your bank does”. If the bank were to recognise the market value of your house, then clearly the value of this asset has shrunk.

This would be bad enough. But other items were also souring on the asset side. Cyprus banks lent to Greek businesses and to Greek property. They also held Greek sovereign debt and maybe — I’m not sure — equity in Greek banks. (I haven’t listed equity holdings in other banks above, but you can slot it in somewhere on the asset side.)

One reason the above is called a “balance sheet” — actually the reason — is that the two sides must be equal. So, if the asset side is shrinking, the question becomes: Where are you going to distribute the losses on the liability side?

You can keep a bank on “life support” by purchasing its bad assets. The government can do this (i.e. the finance ministry / treasury) by replacing these bad assets with good ones. The central bank can do this by taking the bad assets in return for increases in the bank’s balance at the central bank. (Banks keep an account at the central bank, and this account is called their “reserve”.)

The ECB is Cyprus’ central bank. It has said, No more life support. In which case, we’re back to distributing losses. In Cyprus, the assets were funded almost entirely by customer deposits. Hey, it was a big offshore banking centre; of course it had plentiful deposits. And this explains why deposits simply could not be un-touched. The initial idea was to try not to destroy Cyprus’ appeal as an offshore banking centre, by “only” erasing 9.9% of deposits over EUR 100,000. To keep this below 10%, it meant you had to take something from deposits under EUR 100,000. That was outrageous, and didn’t make it through Parliamentary approval in Cyprus.

So the result is no loss for deposits under EUR 100,000 and about a 40 or 50% loss to deposits over that amount. Bear in mind, in exchange, Cyprus will be getting financial assistance from the three international organisations with whom it has been in talks, the so-called Troika constituting the European Commission, the IMF and the ECB.

The IMF has been taking a firmer stance on the amount of “fudge” it is willing to condone. In other words: it has stopped acquiescing in rescue plans that merely pile up an unsustainable debt burden on the rescued economy. Berlin is of a similar mind, and the two of them have pushed through the “rip-off-the-band-aid” approach.

What this means for Cyprus is presumably the loss of its business model: offshore banking. Where GDP will come from is uncertain. I have seen estimates of GDP contraction which range from 20-50%. Naturally Cyprus will soon find it impossible to refinance its sovereign debt: it starts with a debt/GDP ratio of 140% and the denominator is about to fall. My guess is that a TARP-like plan will be deployed to lessen the burden on Cyprus’ creditors when its sovereign debt is written down, at least partially. It will be given whatever other assistance is necessary to stay in the euro-area, because its exit would have the perverse consequence of incentivised failure: Brussels would not want for its success to be a template for other benighted euro-periphery economies. (Although, according to the prevailing dogma, euro-exit can only be calamitous, in which case perhaps exit will be condoned as an object lesson for other economies…)

What this means for the euro area is greater ECB involvement. The Troika have confirmed that “bail-in” is in store for other troubled economies. What “bail-in” means is distributing losses to private-sector creditors. In Cyprus’ case, these happen to be depositors (when you put funds on deposit, you are loaning that money to the bank). The reason financial markets reacted so negatively to the statement by Jeroen Dijsselbloem, head of the eurogroup of finance ministers, that the Cyprus deal is a template for future rescues (a statement upon which he later had to row back), is that, for other euro-area countries, these “private-sector creditors” are bondholders. For banks which rely on bond markets for funding, this was poisonous. Dijsselbloem’s rowback does not solve the problem. Expect ECB President Mario Draghi to reassure markets that his institution will not hesitate to liquefy as and when needed. The ECB, like any central bank, has this power because it alone creates the money for which there is no counterpart liability: the ECB can create money out of thin air.

What this means for non-euro-area. For a start, I would expect renewed weakness in the euro, and strength in the GB pound particularly, as people exercise sensible precautions. I would also expect strength in the gold price. As the saying goes, in bad times it’s not the return on your money that worries you. It’s the return of your money.