|

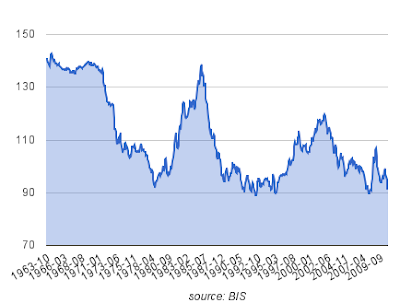

| USA: Real-effective exchange rate |

I’m just astonished at the tripe which passes for sensible economic commentary right now. Take the WSJ 2011 outlook piece from 26 December. It ran in my city’s paper as part of a regular WSJ mini-edition, as it no doubt does in many city papers across the country.

The author tells us that although inflation is not a worry in 2011, the Fed’s balance-sheet expansion is storing up problems for later. This is written with the same authoritative, darkly somber tone that now seems to dominate conventional thinking about the Fed’s activities. It betrays an utter misapprehension of so basic a concept as the money supply.

Do these people think the “money supply” is what the Fed creates? It sure seems that way. They could not be more mistaken. The money supply is composed of everything which can be deployed as money. Most of this is created by the financial system. It is so far-reaching as to defy any reliable counting. But take it on faith that most of the broad money supply is not what the Fed creates. The Fed does create a special type of money, called ‘base money’. The banking system is required to hold this money, and the more of it that the banks hold, the greater their leeway to generate credit, which is money. This is presumably what has some people worried — banks are holding more and more of this special ‘base money’, and may one day use it to write legions of new credit.

In an economy with huge unemployment and excess capacity, that would be a great problem to have!

Returning to the WSJ 2011 outlook. What really got my blood boiling was the dark warning over the dollar’s external value. The author warns that, if the Chinese lose faith in us, they will stop buying our Treasury bonds and the dollar will “tank”. Who would not want this? Oh, yes. The financial services industry. They definitely don’t want a weaker dollar. And this is the WSJ after all. The US economy, on the other hand, wants it badly. We need the dollar to “tank”. We need to give our traded goods and services the level playing field they’ve been denied for so long. Our import-competing industries and our exporters have been getting short-shrift from the “strong dollar” policy since the middle 1990s. (A period which, incidentally, saw the rise and rise of financial services … to what purpose?)

And if a fall in the dollar translates into inflation … so much the better. Check your real interest rate time series and I’m sure you’ll agree.

Scott, although a deflated dollar helps U.S. exports, I don’t see a benefit to my personal well-being. I’m paying inflated prices at the grocery store and gas pump, but see no corresponding inflation in the interest rate on my savings. When do you think the interest rates will rise? -Bets

I think with unemployment near 10% and Europe in slow-meltdown, pressure on interest rates is nil in the medium term. Did I mention a US Congress that wants to contract the government’s spending? The 1930s are my touchstone here, and in that decade interest rates went as low as policymakers felt they could set them, and didn’t budge until WW2.